Commodity markets

Grain market. EU countries // Week 33

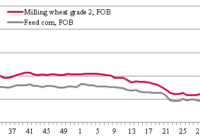

The EU grain market showed a decline in prices for most grains amid pressure from high competition (players noted a huge volume of Russian wheat offered at more competitive prices) and generally favorable weather conditions for the development of crops and field work in the main producing countries.

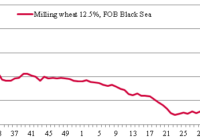

Grain market. Russia // Week 33

Grain market. Kazakhstan // Week 33

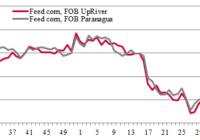

Export quotes for Kazakh-origin wheat increased slightly despite weakening national currency. However, trade remains limited, and players fear another price decline due to the inflow of smuggled Russian wheat.

Grain market. South America // Week 33

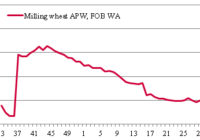

Grain market. Australia // Week 33

In Australia, uncertainty remains over the new crop due to weather conditions, which is holding back producer sales, slowing export trade and supporting prices. In addition, the Grain Industry Association of Western Australia (GIWA) lowered production estimates for Western Australia due to continued dry conditions in most agricultural regions.

Market of complex and potash fertilizers // Week 33

This week, importers’ demand for phosphates has decreased in Brazil. Only customers applying fertilizer for soybeans may be interested in purchasing MAP with shipments in August and early September. The next wave of purchases is expected for the second application (for corn) starting in February 2024.

Nitrogen fertilizer market // Week 33

The global urea market has featured the approval by the Indian IPL to purchase 1.76 million t of urea at $396-399/t C&F for shipments to the east and west coasts of India by September 26. About 1.1 million t of this volume will be shipped from China, 350,000-400,000 t from the Middle East