Soybean market // Week 45

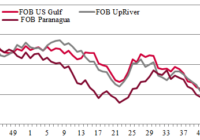

In the U.S., soybean prices have grown sharply amid large purchases by Chinese importers. Thus, during the week, private exporters have reported sales of a total of 1.7 million t of soybeans to China and 1.1 million t of soybeans to an unknown buyer (most likely also China) for shipments during MY 2023-24.