Commodity markets

Grain market. Kazakhstan // Week 44

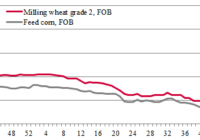

Trade remains slow on the Kazakh grain market. The situation remains difficult as this season the quality of harvested grain is low due to the rainy fall. Only half of the harvested wheat (about 5 million t) is of milling quality, so the presence of Russian grain will only be growing both on the…… Read more »

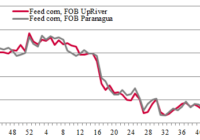

Grain market. South America // Week 44

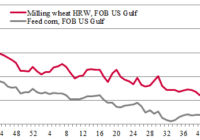

Grain market. USA // Week 44

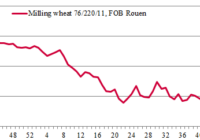

Grain market. EU countries // Week 44

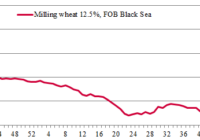

Grain market. Ukraine // Week 44

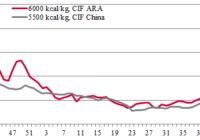

Coal market // Week 43

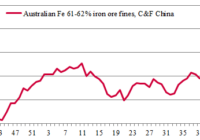

Iron ore market // Week 43

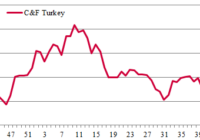

Steel scrap market // Week 43

Nitrogen fertilizer market // Week 43

Trade has been slow on the urea market this week as players were waiting for the results of the Indian tender. On October 26, IPL has purchased about 1.7 million t of urea at $400/t and $404/t C&F India with shipments to the west and east coasts of the country, respectively.