Commodity markets

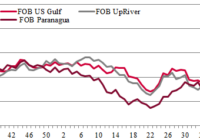

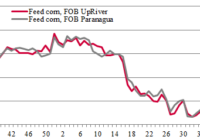

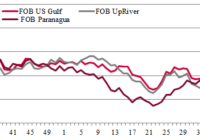

Grain market. South America // Week 38

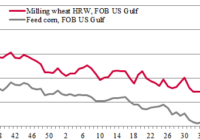

Grain market. USA // Week 38

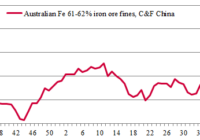

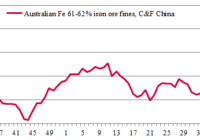

Iron ore market // Week 38

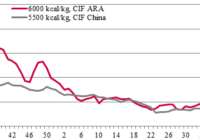

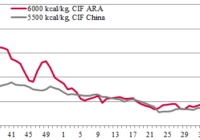

Coal market // Week 38

Nitrogen fertilizer market // Week 37

In the second week of September, Egyptian producers have been offering granular urea at $460-470/t FOB, although the netback from prices in Europe has reached $410-445/t FOB. No signed deals have been reported.

Soybean market // Week 37

Market of complex and potash fertilizers // Week 37

Chinese suppliers have been granted DAP export quotas for Q4 2023 in the amount of 1.2 million t. However, restrictions on urea exports have recently been introduced, so market participants believe that they may also apply to phosphate. The government has reportedly suspended CIQ inspections (authorities that deal with quarantine and inspection of imported…… Read more »