Commodity markets

Grain market. Ukraine // Week 50

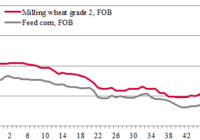

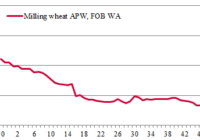

Grain market. Australia // Week 50

Sunflower oil market. Ukraine // Week 50

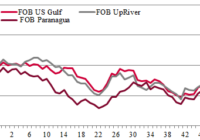

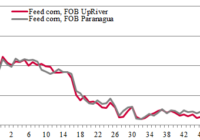

Grain market. South America // Week 50

In Brazil, corn export quotes are declining amid ample global supply. Anec forecasts December corn shipments at 7.14 million t (6.86 million t projected a week earlier). Lack of rainfall in some agricultural areas continues to be a concern, with first-crop corn planting in central and southern Brazil at 95% of plan (96% a…… Read more »

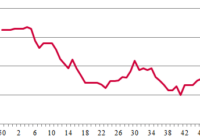

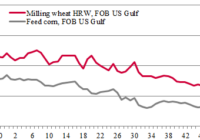

Grain market. USA // Week 50

In the U.S., wheat and corn prices are suffering pressure from USDA’s increased forecasts of global production and trade. In MY 2023-24, the global wheat harvest is expected to reach 783 million t (1 million t more than previously expected), while corn harvest is projected at 1.222 billion t (+1.3 million t). The estimate…… Read more »

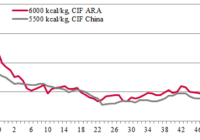

Coal market // Week 50

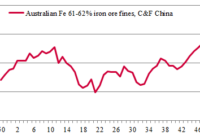

Iron ore market // Week 50

Quotes for iron ore of literally all origins have been fluctuating during the week. Despite encouraging expectations on most market insiders for December, the market conditions have worsened amid growing stocks at China’s ports and overall sluggish demand. Thus, iron ore stockpiles have increased by 2.9 million t to 113.6 million t in Chinese…… Read more »

Steel scrap market // Week 50

Nitrogen fertilizer market // Week 50

The pace of sales has declined on the Egyptian urea market. Only small volumes of the fertilizer (1-2,000 t) have been sold at $337-338/t FOB. At the start of the week, producers were offering both prilled and granular urea at $345-350/t FOB, while later on some companies have started offering granular fertilizer at $340-349/t…… Read more »