Grain market. Kazakhstan // Week 2

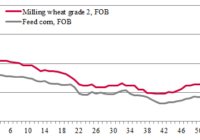

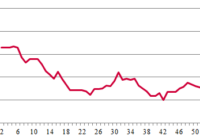

Grain export trade from Kazakhstan has been inactive, although indicative prices have increased. Importers’ demand is weak, while supplies from Russia are growing not only on traditional markets for Kazakh traders, but also in Kazakhstan itself.