Вантажi: Fertilizers and chemicals

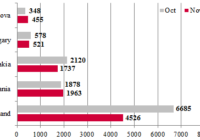

Transshipment of mineral and chemical fertilizers, and raw materials for their production in some Baltic Sea ports in October, thousand tonnes

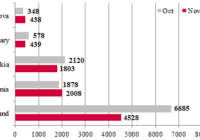

Goods awaiting transfer through Ukraine’s western land border crossing points

Market of complex and potash fertilizers // Week 46

DAP prices have been mostly growing on the global phosphorous fertilizer market. Indian importers are trying to resist this trend by making counter-offers within international tenders. Thus, on November 11, RCF has canceled a tender for the purchase of 45,000 t of DAP, having received only one offer at $600/t from C&F India.

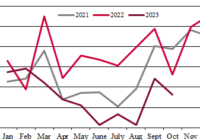

Nitrogen fertilizer market // Week 46

In Egypt, prices for granular urea are hovering at $380-385/t FOB. Abu Qir offers the fertilizer at $380/t FOB and unconfirmed reports show sales of small volumes at this price.

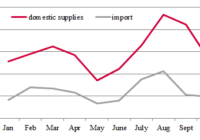

Railway deliveries of mineral fertilizers to Ukrainian consignees

Nitrogen fertilizer market // Week 45

In Egypt, urea producers have returned to work and are operating at full capacity. However, trade remains minimal due to low demand from traders. This week, prices for granular urea are hovering at $400/t FOB. Abu Qir was offering the fertilizer at $395/t FOB Egypt.

Market of complex and potash fertilizers // Week 45

In China, phosphate export quotas for Q4 2023 are almost covered. According to market players, however, it is still possible to export about 200,000-300,000 t of fertilizers in December. Most producers offer DAP for shipments in November, but importers have reportedly requested shipments in December at $570-585/t FOB China.

Riga Freeport cargo turnover in October

Handling at Ukraine – Poland border crossings*

As many as 3,500 wagons were moving to the Izov station on November 2, including 1,200 wagons with cakes, 457 wagons with vegetable oil, and 173 wagons with grain. About 1,600 wagons were on their way to the Mostyska-2 station on that date, including 900 containers.