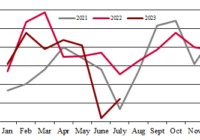

Вантажi: Fertilizers and chemicals

Handling at Ukraine – Slovakia border crossings*

As many as 289 wagons were transferred daily through the Chop – Čierna nad Tisou land border crossing point as of August 3 (up 15 wagons compared with the previous week).

Market of complex and potash fertilizers // Week 31

Prices for phosphate fertilizers were mostly growing on the global market as demand from major consumers remained strong. Quotes surged after GSFC and RCF purchased Moroccan DAF for shipments in August and 1H September at $445-448/ton C&F India.

Nitrogen fertilizer market // Week 31

In Egypt, producers stopped offering urea as European buyers do not hurry to contract large volumes. Like all global market players, they are waiting for the results of the Indian tender. Only two offers of granular urea have been seen this week at $475/t and $490/t FOB.

Kernel receives two vessels with fertilizers in port of Gdansk

The Polish port of Gdansk has received two ships (from Jordan and Morocco) carrying potash and complex fertilizers for Kernel and Sanagro Ukraine (Agrofertrans).

Market of complex and potash fertilizers // Week 30

Demand for phosphates remains high in Brazil and market players expect it to remain at the same level in August. The latest MAP deals in Brazil were concluded at $470-480/t C&F.

Nitrogen fertilizer market // Week 30

Trade has been brisk on the Egyptian urea export market, with deals signed at $400-422/t FOB.

Handling at Ukraine – Poland border crossings*

A total of 14,564 wagons were transferred through the Izov-Hrubieszów land border crossing point in July. The average daily handling speed amounted to 470 wagons (up 109 units per day compared with June). In July, the station daily handled 382 wagons with export cargo and 88 wagons with imported goods.

Market of complex and potash fertilizers // Week 29

The Ukrainian phosphate fertilizer market is generally unchanged. Demand remains low.

Nitrogen fertilizer market // Week 29

In Egypt, urea prices have continued to rise this week, but holidays have started in the country that will last until Monday.