Вантажi: Grain

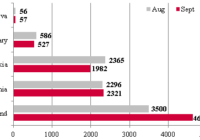

Ukraine’s grain export by rail totals 683k tonnes in September 1-20

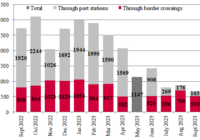

Goods awaiting transfer through Ukraine’s western land border crossing points

RCH transports Ukrainian grain in containers to Italy

At a meeting held by Ukrzaliznytsia with Hungarian carriers, a representative of Rail Cargo Hungaria said that after the successful processing of grain transshipment for transportation to Italy, he expects an increase in the number of train departures in this direction.

Polish logistics operator Treeden Group opens a terminal with 1,520 and 1,435 mm track gauges

UDP reports grain transportation by barge caravans from Hungary to port of Constanta

PJSC Ukrainian Danube Shipping Company is strengthening its cooperation with the world’s largest grain traders; agricultural products will be transported from the Danube ports of European countries to Constanta.

Handling at Ukraine – Romania and Ukraine – Moldova border crossings*

As many as 179 wagons were transferred daily through the the Vadul-Siret – Dornesti (Romania) land border crossing in September 1-19 (down 8 wagon compared with September 1-12).

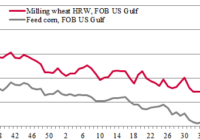

Current situation with exports of Ukrainian agricultural products to the EU

The European Commission does not extend the temporary restriction on imports of Ukrainian agricultural products to Poland, Hungary, Romania, Slovakia and Bulgaria, provided that Ukraine complies with measures that will avoid a significant increase in grain imports.

Ban on transportation of certain cargoes to Hungary for Rail Cargo Hungaria Zrt. and MMV Magyar Maganvasut Zrt.

Starting from September 18 and until the decision is revoked, transportation of certain cargoes from Ukraine to Hungary is prohibited for Rail Cargo Hungaria Zrt. and MMV Magyar Maganvasut Zrt consignees.

Handling at Ukraine – Slovakia border crossings*

About 336 wagons were transferred daily through the Chop – Čierna nad Tisou land border crossing point in the period from of September 1 to September 14 (down 4 wagons compared with September 1-7).