Вантажi: Grain

Grain market. EU countries // Week 33

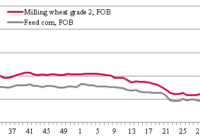

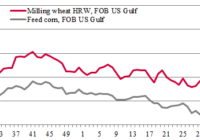

The EU grain market showed a decline in prices for most grains amid pressure from high competition (players noted a huge volume of Russian wheat offered at more competitive prices) and generally favorable weather conditions for the development of crops and field work in the main producing countries.

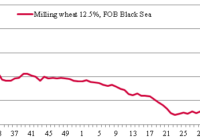

Grain market. Russia // Week 33

Handling at Ukraine – Hungary border crossings*

As many as 562 wagons were heading to the Batiovo – Epereshke land border crossing point on August 21, of which 182 wagons were loaded with grain, 105 wagons with vegetable oil, and 16 wagons with cakes.

Handling at Ukraine – Romania and Ukraine – Moldova border crossings*

About 145 wagons were transferred daily through the the Vadul-Siret – Dornesti (Romania) land border crossing as of August 22 (down 8 wagons compared with the previous week).

Port of Klaipeda cargo turnover in July

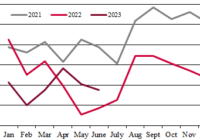

Grain market. Kazakhstan // Week 33

Export quotes for Kazakh-origin wheat increased slightly despite weakening national currency. However, trade remains limited, and players fear another price decline due to the inflow of smuggled Russian wheat.

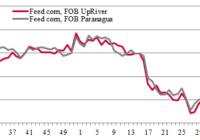

Grain market. South America // Week 33

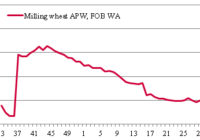

Grain market. Australia // Week 33

In Australia, uncertainty remains over the new crop due to weather conditions, which is holding back producer sales, slowing export trade and supporting prices. In addition, the Grain Industry Association of Western Australia (GIWA) lowered production estimates for Western Australia due to continued dry conditions in most agricultural regions.