Вантажi: Fertilizers and chemicals

Market of complex and potash fertilizers // Week 2

The phosphate market has been stable in Brazil. MAP 11:52/12:52 is still offered at $560/t C&F. One of market participants reports that fertilizer purchases made by customers last year have created large carryover stocks, which does not contribute to the growth of MAP prices.

Nitrogen fertilizer market // Week 2

Global urea market players have once again focused on the information on the tender in India. This week, NFL has published the prices of the tender held on January 4, when 2.7 million t of the fertilizer were purchased: levels were within $316.8-359.3/t C&F.

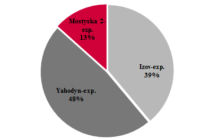

Railway deliveries of mineral fertilizers to Ukrainian consignees

Riga Freeport cargo turnover in December

Port of Klaipeda cargo turnover in December

The cargo turnover dropped by 230,000 t to 3.4 million t at the Port of Klaipeda in December compared with November. In particular, Klaipeda State Seaport reports a 132,000 t plunge in December transshipment volume to 2.7 million t. Handling of crude oil dropped by 98,000 t to 692,000 t at the Butinge terminal.

Market of complex and potash fertilizers // Week 52, 2023 – week 1, 2024

The Indian phosphate market has seen several new purchases of DAP. Thus, IPL has bought 45,000 t of the fertilizer from Ma’aden at $595/t C&F India for shipment in January. In addition, Ma’aden has sold about 60,000 t of DAP to India and Thailand at $595/t C&F and $600/t C&F, respectively.

Nitrogen fertilizer market // Week 52, 2023 – week 1, 2024

The tender from Indian NFL has been the main event on the global urea market. The total volume of the fertilizer offered within the tender amounted to 2.8 million t, with no prices reported.

Market of complex and potash fertilizers // Week 51

The phosphate market has been volatile in Brazil. MAP 11:52 is reportedly being offered at the same price as last week. However, Eurochem has started offering MAP 12:52 at lower prices.

Nitrogen fertilizer market // Week 51

Despite low demand on the global market, Egypt has sold some urea this week, with unconfirmed data suggesting contract prices of $330-340/t FOB. No fresh spot deals have been reported in the Middle East.