Вантажi: Grain

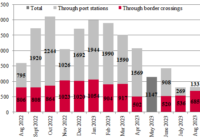

Goods awaiting transfer through Ukraine’s western land border crossing points

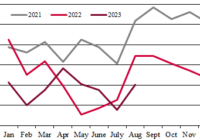

Ukraine exported 193k tonnes of grain by rail in September 1-6

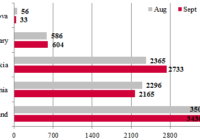

Liepaja SEZ cargo turnover in August

Port of Klaipeda cargo turnover in August

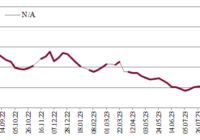

Wagon queues at land border crossings*

Ukraine starts exporting grain via Croatian ports

Ukraine has started exporting grain through Croatian ports. This was stated by the First Vice Prime Minister of Ukraine, Minister of Economy of Ukraine Yulia Svyrydenko during a meeting with the Prime Minister of the Republic of Croatia Andrej Plenkovic.

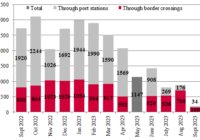

Handling at Ukraine – Romania and Ukraine – Moldova border crossings*

As many as 101 wagons were transferred daily through the the Vadul-Siret – Dornesti (Romania) land border crossing as of September 5 (down 45 wagon compared with the previous week).

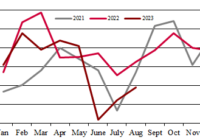

Handling at Ukraine – Hungary border crossings*

As many as 530 wagons were heading to the Batiovo – Epereshke land border crossing point on September 4, of which 161 wagons were loaded with ore, 177 wagons with grain, and 91 wagons with vegetable oil.