Вантажi: Grain

Grain market. Ukraine // Week 13

Fram Shipping to handle grain at Reni port

Fram Shipping is going to start business on the territory of the Reni seaport. The company focuses on handling export dry bulk cargo.

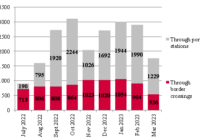

Grain and vegetable oil transshipment in some Ukrainian ports in February, thousand tonnes*

Grain and sugar transshipment in some Baltic Sea ports in February, thousand tonnes

New multimodal terminal planned to be built in Reni

On March 22, Reni Terminal Development LLC (whose ultimate beneficiary is Andriy Verevsky, Chairman of the Board of Directors of Kernel) received a permit to build a multimodal terminal in the city of Reni.

Riga Freeport cargo turnover in February

Handling at Ukraine-Poland border crossings*

A total of 11,925 wagons were transferred through the Izov-Hrubieszów border crossing in the period from March 1 till March 22, with about 534 wagons served there per day (up 56 units per day compared with February)

Over 1.76 mmt Ukrainian grain carried by rail in March 1-22

Handling at Ukraine-Romania and Ukraine-Moldova border crossings*

Vadul-Siret – Dornesti (Romania) land border crossing served about 191 wagons per day in the period from March 1 till March 21 (two trains on a 1520 mm gauge track and two trains on a 1435 mm gauge track).